Exchange-traded funds (ETFs) have revolutionized the world of investing. These versatile financial instruments offer an accessible and cost-effective way to access a wide range of assets, from stocks and bonds to commodities and real estate. In this article, we’ll explore how investors can maximize their returns and profit from ETFs by understanding their unique features, benefits, and various strategies for effective utilization.

Understanding ETFs

Exchange-traded funds are investment funds that trade on stock exchanges, similar to individual stocks. They are designed to track the performance of a specific index, sector, or asset class. ETFs offer the benefits of diversification, transparency, and flexibility, making them an appealing option for both novice and experienced investors.

Benefits of Investing in ETFs

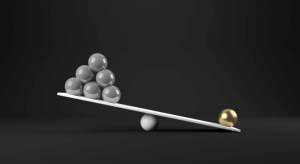

Diversification: ETFs provide exposure to a broad range of assets, reducing the risk associated with investing in individual stocks or bonds. Diversification helps spread risk and minimize the impact of poor-performing assets.

Liquidity: ETFs are traded on stock exchanges, providing liquidity and the ability to buy or sell shares throughout the trading day. This liquidity makes them an attractive choice for active traders.

Lower Costs: ETFs generally have lower expense ratios compared to actively managed mutual funds. This cost advantage can enhance long-term returns.

Transparency: ETFs disclose their holdings daily, allowing investors to know precisely what assets are held within the fund. This transparency fosters trust and informed decision-making.

Strategies for Profiting from ETFs

Passive Index Investing: One of the simplest and most common strategies is to use ETFs for passive index investing. By purchasing an ETF that tracks a broad market index like the S&P 500, investors can gain exposure to a diversified portfolio of stocks. Over the long term, this approach tends to yield competitive returns with lower fees than actively managed funds.

Sector Rotation: ETFs offer the flexibility to focus on specific sectors or industries. Investors can use sector-specific ETFs to capitalize on trends or market shifts. For instance, during a technology boom, technology sector ETFs may perform exceptionally well.

Geographic Diversification: ETFs provide easy access to global markets. Investors can profit from international opportunities by investing in ETFs that track foreign indices or specific countries’ markets.

Asset Allocation: ETFs can be used to build a diversified asset allocation strategy. By combining ETFs that cover different asset classes, such as stocks, bonds, and commodities, investors can tailor their portfolios to match their risk tolerance and financial goals.

Hedging and Risk Management: ETFs can also be used for hedging and risk management. Inverse ETFs are designed to move in the opposite direction of a specific index or asset class, allowing investors to profit from declining markets or to protect their portfolios from potential losses.

Dividend and Income Strategies: For income-focused investors, dividend ETFs offer exposure to a basket of dividend-paying stocks. This strategy can provide a consistent stream of income, making it appealing to retirees and income-seeking investors.

Tips for Successful ETF Investing

Research and Due Diligence: Conduct thorough research before investing in an ETF. Understand the underlying index, asset class, and fees associated with the fund. Reading the prospectus is essential.

Keep an Eye on Costs: While ETFs generally have lower expense ratios than mutual funds, fees can still vary. Choose ETFs with competitive fees to maximize returns.

Consider Tax Implications: ETFs are known for their tax efficiency, but it’s important to understand potential tax consequences, such as capital gains distributions.

Regular Rebalancing: Periodically review your portfolio and rebalance your ETF holdings to maintain your desired asset allocation. This ensures that your portfolio aligns with your investment goals.

Stay Informed: Keep up with market news and developments that may affect your ETF investments. Economic and geopolitical events can impact the performance of different asset classes.

Diversify Your ETF Portfolio: Diversification remains a fundamental strategy for risk management. Use a mix of ETFs to spread risk across various asset classes and regions.

ETFs are a powerful tool for investors looking to maximize their returns while maintaining flexibility, diversification, and cost efficiency. By understanding the benefits of ETFs and adopting effective investment strategies, investors can harness the full potential of these financial instruments. Whether you’re a long-term investor seeking passive index exposure or an active trader exploring sector rotations and income strategies, ETFs provide numerous opportunities for profitable investing in today’s dynamic financial markets.