Investing is not just about securing your financial future; it’s also an opportunity to leave a lasting legacy for your loved ones. Gifting stocks to your grandchildren can be a thoughtful and valuable way to impart important financial lessons and help them achieve their long-term goals. In this article, we’ll explore seven stocks that you can consider gifting to your grandchildren, with the potential for both growth and educational value.

- Disney (DIS):Disney has been a beloved household name for generations. Owning shares of Disney provides a stake in a company that has successfully diversified into various forms of entertainment, from movies to theme parks to streaming services. It’s a valuable lesson in the power of diversification and innovation.

- Coca-Cola (KO):Coca-Cola is not just a soda company; it’s a symbol of enduring brand strength. Gifting shares of Coca-Cola demonstrates the concept of dividends and the impact of long-term brand recognition on stock performance.

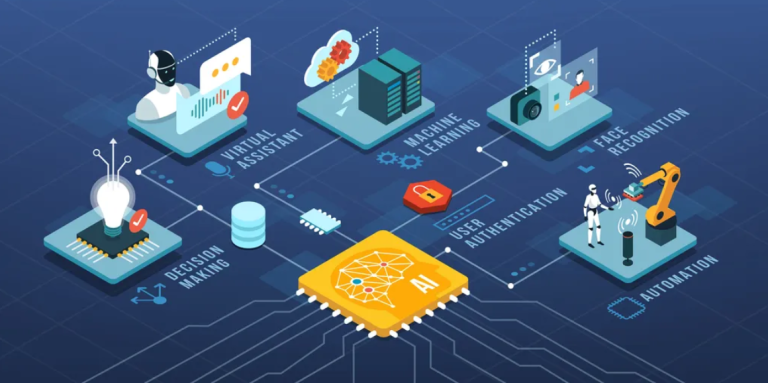

- Alphabet Inc. (GOOGL):Alphabet, the parent company of Google, is at the forefront of technology and innovation. Owning shares can educate your grandchildren about the importance of staying updated with the latest trends and the potential growth in the tech sector.

- Johnson & Johnson (JNJ):A classic healthcare stock, Johnson & Johnson illustrates the importance of stability and resilience. It’s a company that has weathered economic storms and serves as a lesson in the reliability of dividend-paying stocks.

- Amazon (AMZN):Amazon is not only an e-commerce giant but a trailblazer in the tech industry. Gifting Amazon shares can teach your grandchildren about disruptive business models and the rewards of forward-thinking companies.

- Visa Inc. (V):As the world becomes increasingly cashless, Visa stands as a testament to the global shift in payment systems. This stock gift can underscore the significance of understanding evolving financial landscapes.

- Nike (NKE):Nike, a leader in the sports and athletic industry, represents the value of strong branding and international reach. It’s an opportunity to introduce the concept of global markets and consumer behavior.

Tips for Gifting Stocks to Grandchildren:

Open a Custodial Account: Consider setting up a custodial brokerage account in the child’s name, managed by a custodian (usually a parent or guardian) until the child reaches the age of majority.

Educate Along the Way: Use the gift of stocks as an opportunity to educate your grandchildren about investing, dividends, and the power of long-term wealth accumulation.

Diversify the Holdings: Choose stocks from different sectors to help the child understand diversification and risk management.

Keep It Personal: Select stocks that resonate with your grandchild’s interests and values, making the gift more meaningful.

Gifting stocks to your grandchildren is a wonderful way to impart financial wisdom, encourage long-term thinking, and set them on a path to financial independence. The seven stocks mentioned above offer a blend of tradition, innovation, resilience, and global reach, providing valuable lessons as they grow and manage their own investments. By investing in their future, you contribute to their financial education and the potential for generational wealth.